How can we get members to care about their pensions? The proven answer is: show them their money is invested responsibly. Here’s how to do it...

Why can’t we get members to engage? Because we make pensions sound like Something To Not Care About.

As an industry, everything we tell members about pensions positions them as something to ignore. We make them sound:

- far away – whether retirement is 3 months or 30 years away, nothing about a pension is happening now.

- intangible – what does a pension look like? It’s invisible. It’s easy to ignore what you can’t see – and save up for something you can, like a house.

- hard to understand – everything sounds confusing. Risk? Return? Salary sacrifice? (When has ‘sacrifice’ ever been a good thing?)

- passive – as a member of a pension scheme, your money just… leaves your payslip. You don’t do anything to make that happen.

The result: pensions are Something To Not Care About. And herein lies our problem. If we want to get members to do anything about their pension, they have to care. That’s because, as humans, we’re prone to making decisions based on emotion then hunting for facts to back up conclusions we’ve already reached. ‘We have dog brains, basically, with a human cortex stuck on top, a veneer of civilization’, as the Harvard Business Review indelicately puts it.

So, how do we get members to care? The answer is responsible investment.

Responsible investment can increase trust, engagement, and membership, according to research from the Defined Contribution Investment Forum.

When we bring responsible investment to life for members, pensions become something that’s:

- happening right now – the money that leaves your payslip is invested in companies, and those companies are doing real things – right now, every day.

- tangible and real – your money might be creating jobs, building solar panels, or influencing the board of that big company you’ve heard of to make it more diverse. Pensions aren’t invisible any more.

- easier to understand – risk and return means nothing if you think your money’s sitting in a savings account. But if you know it’s invested in the real world, it starts to make a little more sense.

- powerful – a pension is no longer something that’s done to you. It’s something you’re doing – you’re investing. And together, you and your pension scheme have the power to make change.

Show members what their money is doing

When members can see what their money is doing, they have a reason to care.

If members care, they’re more likely to engage. If they engage, they’re more likely to register online, nominate their beneficiary, contribute more – whatever action it is that you’re looking for them to take.

This could unlock £1.2bn in contributions, according to research from Franklin Templeton. Even in the beginnings of the cost of living crisis, people still said they’d contribute more if they knew their money was doing good, as research from LGIM found. That’s financial resilience boosted. It’s more money invested today to fund the solutions of tomorrow. It’s good for our members and good for the whole planet.

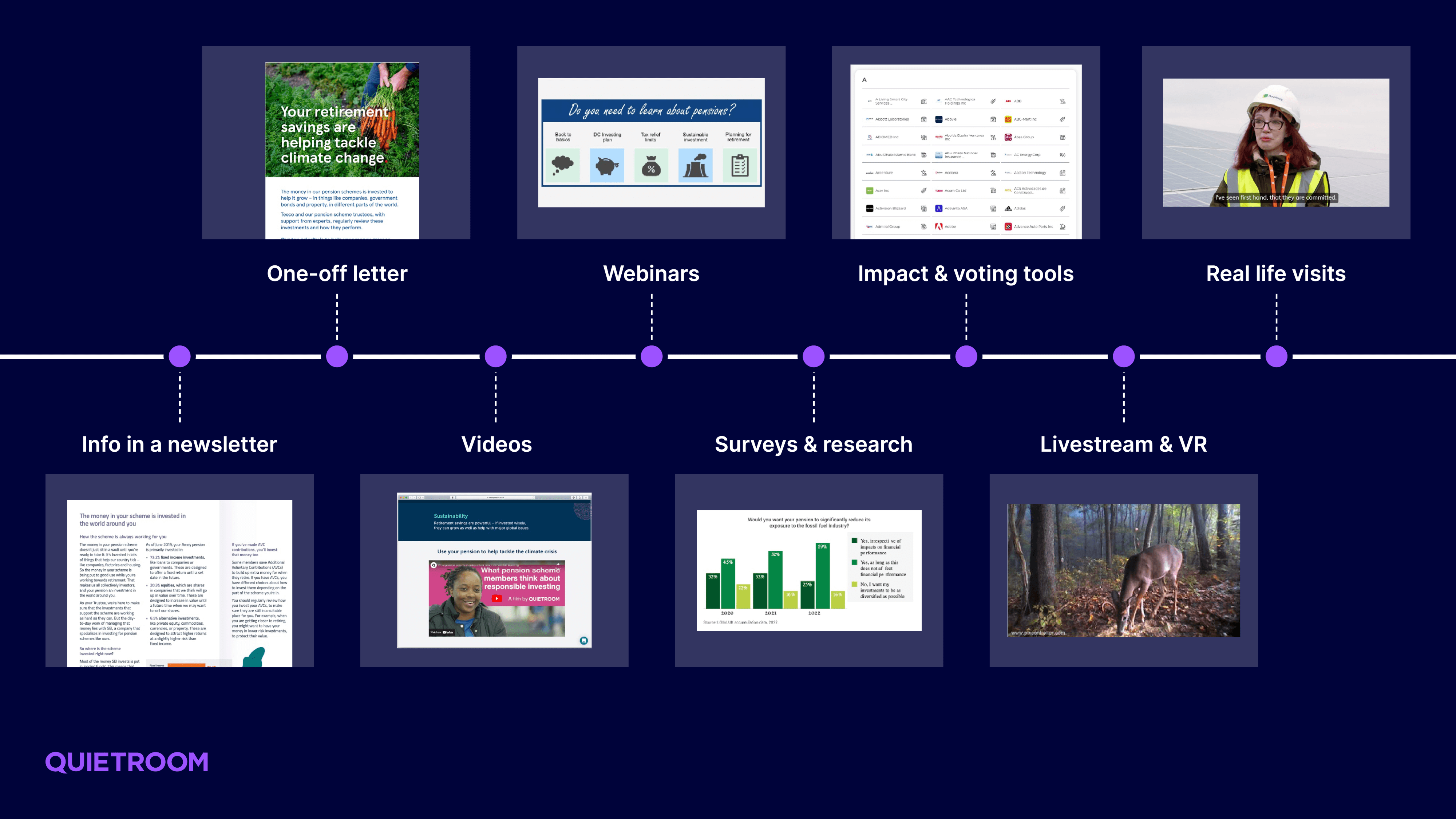

There are lots of ways to do this. These include:

- examples of investments in newsletters or ad hoc comms

- webinars and roundtables, to invite members’ views and questions

- impact tools that show members their pension’s carbon footprint, give members a say in how the companies they invest in are run or take them on trips to see their investments for real

The best communications do 3 things

1. Tell the story in the right order

Responsible investment makes no sense if you don’t know that your pension is invested in the first place. So cover the all important building blocks, so no one’s missing any fundamental information. Like:

- Your pension money is invested.

- It’s invested in companies and buildings and governments all around, like Coca-cola, Sainsburys, Ecolabs, [your local shopping centre, and other examples from your portfolio].

- Those companies do [real things, like create jobs, provide clean water, build hospitals, whatever examples you can give].

- As those companies grow, your money grows too.

- We’re using our investor influence to make those companies even better – then they’re more likely to make your money grow.

To see some of these building blocks in practice, take a look at this net zero communication from the Tesco pension schemes.

2. Make investments tangible

What is it? Where is it? What’s it doing? What does it look like? Paint a picture, and include a literal picture, of what members’ money is investing in. Bonus points if you can explain the good it’s doing in the world, like the biomass plant in North Lincolnshire that’s powering 75,000 homes, which Nest shows on its website.

3. Show how these investments are good for your pot, people and planet

Understandably, most members’ highest priority when it comes to their pension is how much money they’ll get. So show why these responsible investments are the best choice for their pot as well as the planet – we’ve written about how to do this in our responsible investment communication guide. For example, USS showcase their investment in solar farm company Bruc Energy in their member-friendly TCFD summary. Not only is renewable energy great for the planet, ‘the decades-long lifespan of solar panels makes them well-suited to us, because we need to pay members’ pensions long into the future’.

The fact that money can do good while it grows is still one of the best kept secrets. Until now.

The rest of the finance world – retail investment, banking, insurance – is moving in on this. In the next year, expect to see the consumer space flooded with messages that help people make the connection between their money and the real world. But why wait for that, when you can tell your members now – and reap the rewards of engagement?

To see what it looks like when people make the connection between their pension money and the real world, watch our video.